Analysis of Forest Environment Transfer Tax and Prefectural Policies: Typology of Prefectural Support to Municipalities in the Initial Phase from 2019 to 2021 in Japan

Authors

Yuya Suzuki, Yuta Uchiyama, Satoshi Tachibana, Koji Miwa, Ryo Kohsaka*

Abstract

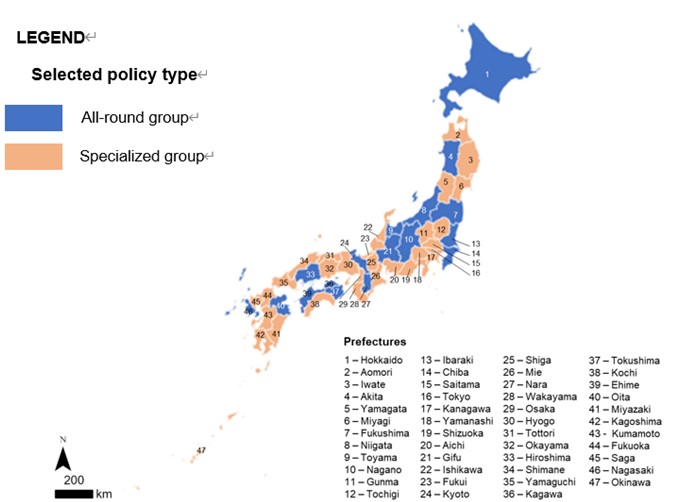

The Forest Environment Transfer Tax (FETT), a scheme similar to Payment for Ecosystem Services (PES), was introduced for Japanese forests at the national level in 2019 to address the challenges of climate change and promote management mainly in privately owned forests under the New Forest Management System (NFMS). In addition, since the FETT is a new scheme that has recently been introduced, it is necessary to continue to analyze the trends in cooperation between prefectural forest management support and municipal forest management practices and their impact on the effectiveness of forest management. Furthermore, given insufficient human and financial resources, support by prefectures for municipalities is a key step forward, and we examined the policies of 47 prefectures. Therefore, we conducted the following analysis: (1) categorization of prefectures by cluster analysis based on questionnaire surveys, and (2) quantitative analysis of the relationship between policy choices and characteristics of prefectures. The study period is from 2019 to 2021. Based on the analyses, we identified two typologies of prefectures based on policy selections and changes; (i) prefectures focused on specific policy items and (ii) those distributed the FETT budget relatively uniformly for each policy item, and further trends of changes based on temporal sequences in the early years of the scheme. The results suggest two further implications: geographical proximity among prefectures and the ratio of forestry production outputs among the overall outputs of agriculture, forestry, and fisheries may affect policy choices by prefectures, especially those of the former type of prefectures. This study contributes to the accumulation of time-series information and provides basic information for analyzing its impact on the achievement of medium- and long-term policy goals, such as the promotion of forest development and human resource development. Furthermore, the findings of this study can contribute to an understanding of the factors influencing policy choices in the context of PES-related schemes for forest management.

The results derived from the JSPS (JP23KK0198, JP23H01584, JP23H03605, JP22H03852, JP21K18456, and JP17K02105) carried out in the laboratory. This study was conducted as a part of the scientific research and development program for the JST/RISTEX science and technology innovation policy "Development and practice of consensus formation method for promotion of policy compatible with agriculture and forestry production and environmental conservation"(https://www.jst.go.jp/ristex/stipolicy/project/project40.html).

Paper Information

- Journal

- Journal of Forest Research

- Title

- Analysis of Forest Environment Transfer Tax and Prefectural Policies: Typology of Prefectural Support to Municipalities in the Initial Phase from 2019 to 2021 in Japan

- DOI

- 10.1080/13416979.2024.2314551

- URL

- https://www.tandfonline.com/doi/full/10.1080/13416979.2024.2314551